Legalization Leaps Forward in the Land of Lincoln

Illinois Becomes First State to Legalize Recreational Marijuana Sales via Legislature; Bill will be “Transformational,” says Governor

This will have a transformational impact on our state, creating opportunity in the communities that need it most and giving so many a second chance. I applaud bipartisan members of the General Assembly for their vote on this legislation.

— Governor JB Pritzker (@GovPritzker) May 31, 2019

In a landmark move, the Illinois state legislature approved a sweeping cannabis reform bill Friday that legalizes the possession, cultivation, sales, and use of Marijuana by adults over the age of 21. The bill also defines a program to expunge the records of over 700,000 individuals previously convicted for minor possession infractions.

The bill now heads to first-year governor JB Pritzker, who campaigned on the issue and has vowed to sign it. Illinois will become the 11th state to pass an adult-use recreational bill, along with the District of Columbia. Commercial marijuana sales operations are expected to begin on Jan 1, 2020, according to the bill.

“It’s a state of 13 million people with a very large tourist population in the Chicago area, so I think the business opportunities are huge,” said Kris Krane, president of 4Front Holdings, an Arizona-based multi-state operator and consulting firm, to Marijuana Business Daily.

“It’s no small feat to do something like this through the state legislature…Illinois is likely just the first domino to fall.”

Illinois joins Vermont as the only states to pass legal cannabis use laws via their legislatures, as opposed to ballot initiative or referendum. Illinois is the first state legislature to pass a bill that allows for to commercial sales of marijuana (the Vermont law is limited to possession and home use, and does not permit sales of any marijuana outside of home-grow supplies and services).

Here are some of the measure’s details, as outlined by Marijuana Business Daily:

- Illinois residents over 21 can posses 30 grams of cannabis flower, and five grams of cannabis concentrates such as hash oil.

- A 10% tax would apply to cannabis products with less than a 35% THC content, a 20% tax on products infused with cannabis (like edibles), and 25% tax for any products with THC content above 35%.

- The 55 existing licensees for medical dispensaries will get an early start and are permitted to begin sales on Jan 1, 2020. They will all be allowed to open an additional store as well, meaning up to 110 stores could be selling recreational cannabis in early 2020.

- The first licensing round would take place on May 1, 2020, and award up to 75 permits for stores. By July 1, 40 processors and 40 craft growers could be granted permits.

- In December, the second wave would allow the state to issue licenses for 110 additional stores, 60 processors and 60 growers.

- Supply-and-demand analysis will allow for a third licensing round if necessary.

As to the economic impact of cannabis legalization in Illinois, a study released last March by cannabis consulting firm Freedman & Koski estimates the state’s annual marijuana market could range from $1.69 billion and $2.58 billion. They added that annual consumption could amount to 350,000-550,000 pounds, based on estimates referencing Colorado’s experience with legalization since 2014.

The business landscape is likely to be competitive, according to Micahel Mayes, CEO of of Quantum 9, a Chicago-based cannabis consulting firm, saying the opportunities are “strong” and that his company has organization has received a “ridiculous amount of inquiries—over 2,000—that run the gamut from publicly traded companies to small craft growers” since the Governor announced the plan for legalization in early May.

“Cannabis was at the heart of our nation’s disastrous War on Drugs. This is a measure that will improve people’s lives on a level commensurate with the devastation wrought by prohibition…Illinois is on the brink of replacing a shameful, destructive policy with the most far-reaching cannabis law ever enacted.”

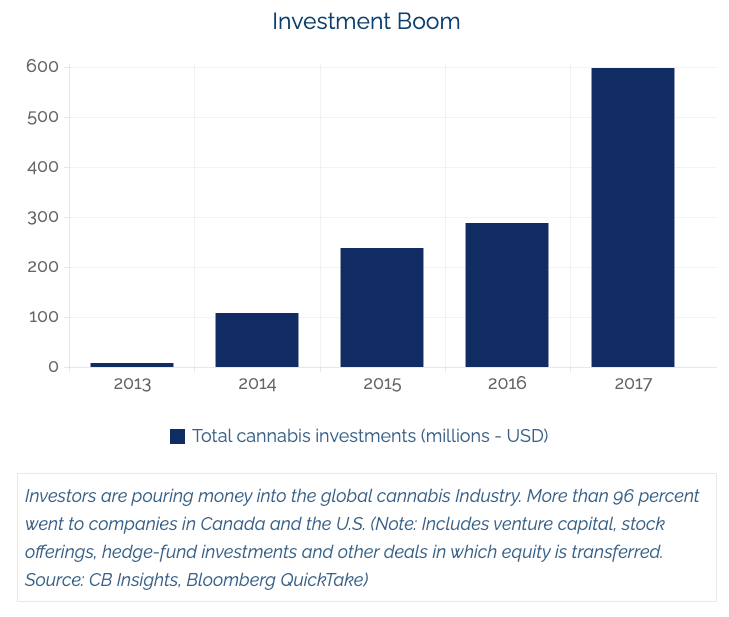

Investors are pouring money into the global cannabis Industry. More than 96 percent went to companies in Canada and the U.S. (Note: Includes venture capital, stock offerings, hedge-fund investments and other deals in which equity is transferred. Source: CB Insights, Bloomberg QuickTake)

CBO: SAFE Banking Act Would Boost Deposits by $1.4 Billion in First Two Years & Cut Federal Costs by $4 Million

The Congressional Budget Office released a report last week issuing a score to the banking reform bill known as the SAFE banking act, estimating it would increase deposits in banks and credit unions by $1.4 billion in the first two years and $2.45 billion by year nine.

Want 4 million more reasons why members of Congress should support the #SAFEBankingAct, which would allow cannabis businesses to access the banking system in the 33 states where it’s legal? @USCBO says the legislation will save taxpayers $4M over 10 years.

— American Bankers Association (@ABABankers) May 24, 2019

The office also estimates the bill would cut federal costs by $4 million over that same nine-year period, increasing its momentum at a key point in its young legislative life.

The bipartisan measure, which cleared the House Financial Services Committee in a 45 to 15 vote earlier this year, would protect banks involved in the cannabis industry from being penalized by regulators. The CBO posited that this would set off a chain of events, starting with an increase in the number of banks that accept deposits from cannabis business.

Industry experts agree with the CBO. Michael Correia, director of government relations for the National Cannabis Industry Organization, issued the following comments to Marijuana Moment:

“For years, cannabis advocates have been preaching the net benefits SAFE Banking would have on consumers, patients, financial institutions, regulators and taxpayers. This CBO cost estimate confirms that. The increase of insured deposits, coming from the added certainty this legislation brings, far outweighs the minor administrative costs to implement this bill.”

Sahar Ayinehsazian, an associate attorney at Vicente Sederberg LLP who specializes in cannabis banking, said the estimated increase in deposits to credit unions may well end up being higher than expected, since marijuana business tend to prefer them over traditional banks.

Pressure on federal legislators to seriously consider the bill in increasing. In the House, the SAFE banking act currently boasts 184 co-sponsors, while its sister bill in the Senate has 30—bipartisan in both cases.

“Looking at the chances of this legislation passing from an economic standpoint, I think [the CBO score is] good news.”

Rand Paul: “Good Chance” SAFE Banking Act Gets Senate Hearing

Republican Senator and 2016 presidential candidate Rand Paul was optimistic about the chances the landmark cannabis banking reform bill known as the SAFE Banking act would get a hearing in the Senate in comments to Marijuana Moment on Tuesday. Senator Paul cited a conversation he had with Senator Mike Crapo (R-ID), who chairs the senate banking committee.

“I’ve talked with Senator Crapo about it. I think there’s a good chance they’re going to bring it up.””

The bill has gained media attention because it has bipartisan support and could be the first stand-alone cannabis reform bill to pass Congress.

Senator Kevin Cramer (R-ND) was present during the discussion with Paul and Crapo and discussed the outcome with Marijuana Moment: “I thought he was quite open-minded to it.”

Cramer said the tone of the discussion was to help Crapo become “more comfortable” with the legislation by focusing the bill’s purview on the issue of banking and not with the issue of federal de-scheduling:

“[Federal legalization] can be sorted out, but shouldn’t prevent us from discussing the banking-specific piece of it.”

When asked about Cramer’s efforts advancing the bill, fellow banking committee member Richard Shelby (R-AL) hinted, “I try to support him.”

California Senate Passes Bill to Create State-Chartered Cannabis Banks

The California senate approved a measure to create a state-chartered bank for cannabis companies by a vote of 35-to-1 this month, in a big step forward and show of support for state-legal cannabis industry.

The bill would allow banks to apply for a special state charter to provide limited depository services to pot businesses. It would also enable the use of special checks the businesses to perform commonplace tasks such as paying state and local taxes, fees, and rent.

States where cannabis is legal have had difficulty collecting tax revenue due to restrictions on banking access. Many cannabis companies pay their taxes in cash and are forced to hire private security as their large amounts of cash-on-hand make them tantalizing targets for armed robbery and embezzlement.

The passage of a law like this in the country’s most populous state could add more pressure to federal lawmakers to address the issue and come up with a solution for cannabis banking. The SAFE banking act is still making its way through congress in D.C., although initial signs have been promising.

When Steve Hawkins, the executive director of the Marijuana Policy Project (a national marijuana reform advocacy group) was asked about how the the possibility of this bill would affect the prioritization of cannabis banking reform at the federal level, he was blunt: “Congress will have to act because there’s all the interstate ramifications of banking that just really cry out for federal lawmakers to do something in this space.

“[It’s] the most far-reaching cannabis law ever enacted”

DISCLAIMERS: This site is not intended to provide any investment, financial, legal, regulatory, accounting, tax or similar advice, and nothing on this site should be construed as a recommendation by Key Investment Partners LLC, its affiliates, or any third party, to acquire or dispose of any investment or security, or to engage in any investment strategy or transaction. An investment in any strategy involves a high degree of risk and there is always the possibility of loss, including the loss of principal. Nothing in this site may be considered as an offer or solicitation to purchase or sell securities or other services.

Leave a Reply

Want to join the discussion?Feel free to contribute!